Why Lower Rates

Could Cost You More

Many Philadelphia-area families that qualify for subsidies to help pay for individual health insurance plans under the Affordable Care Act will see lower rates — and lower subsidies — in 2019 for two reasons: Competition and subsidy rules.

The subsidies are based on the second-lowest “silver” plan, which this year is Independence Blue Cross’ Personal Choice EPO Silver Reserve. Next year, the second-lowest cost is the less-expensive Centene Ambetter Balanced Care 11.

This is good news for people who have to pay the whole cost themselves. But families that received an income-based subsidy this year and want to keep their plan may find it is much more expensive next year.

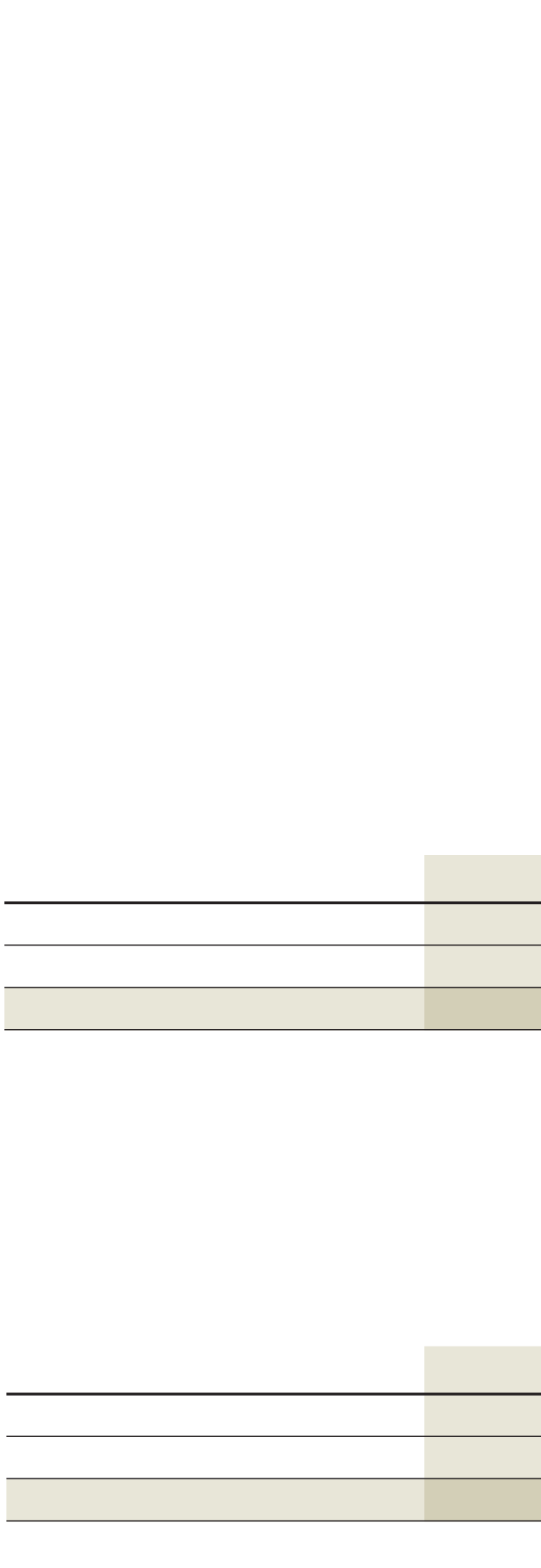

Keystone HMO Silver Proactive Plan

Family: Four members, ages 45, 44, 15, and 13

Annual income:

$80,000

Monthly costs

2018

2019

Change

Premium

$1,617

$1,659

+$42

Subsidy

$1,570

$1,005

–$565

Out of pocket

$47

$654

+$607

What’s the alternative? Come up with a lot more cash, or use the subsidy on a “bronze” plan, which comes with a much higher deductible and other cost-sharing increases.

EPO Bronze Reserve

Family: Four members, ages 45, 44, 15, and 13

Annual income:

$80,000

Monthly costs

2018

2019

Change

Premium

$1,482

$1,322

–$160

Subsidy

$1,570

$1,005

–$565

Out of pocket

$0

$317

+$317

SOURCE: Independence Blue Cross

Staff Graphic

Why Lower Rates

Could Cost You More

Many Philadelphia-area families that qualify for subsidies to help pay for individual health insurance plans under the Affordable Care Act will see lower rates — and lower subsidies — in 2019 for two reasons: Competition and subsidy rules.

The subsidies are based on the second-lowest “silver” plan, which this year is Independence Blue Cross’ Personal Choice EPO Silver Reserve. Next year, the second-lowest cost is the less-expensive Centene Ambetter Balanced Care 11.

This is good news for people who have to pay the whole cost themselves. But families that received an income-based subsidy this year and want to keep their plan may find it is much more expensive next year.

Keystone HMO Silver Proactive Plan

Family: Four members, ages 45, 44, 15, and 13

Annual income:

$80,000

Monthly costs

2018

2019

Change

Premium

$1,617

$1,659

+$42

Subsidy

$1,570

$1,005

–$565

Out of pocket

$47

$654

+$607

What’s the alternative? Come up with a lot more cash, or use the subsidy on a “bronze” plan, which comes with a much higher deductible and other cost-sharing increases.

EPO Bronze Reserve

Family: Four members, ages 45, 44, 15, and 13

Annual income:

$80,000

Monthly costs

2018

2019

Change

Premium

$1,482

$1,322

–$160

Subsidy

$1,570

$1,005

–$565

Out of pocket

$0

$317

+$317

SOURCE: Independence Blue Cross

Staff Graphic